Editor's Note: This text is a transcript of the course, Payment for SLP Services: Navigating Payer Sources, Payment Systems, & Practice Settings, presented by Dee Adams Nikjeh, PhD, CCC-SLP, ASHA Fellow.

Learning Outcomes

After this course, participants will be able to:

- Identify and contrast multiple payer sources for SLP services.

- Define and differentiate payment systems and practice settings for Medicare Part A, Part B (aka Original Medicare), and Part C (Medicare Advantage Plans).

- Describe SLP supervision requirements with respect to multiple healthcare practice settings and payer sources.

Introduction

Let me tell you where the title for this course came from. If I ask ten different SLPs the same question about coding and payment for a particular procedure, I probably get 15 responses back. People frame their responses based on their own experiences and some of those experiences obviously differ depending on your payer sources, payment systems, and practice settings. So, the responses that you give and the responses that you receive may be inaccurate because of all of those variables.

Know Your Payers

Let's begin with knowing your payers. We have three main types of payers: self-pay which is also private pay, commercial payers such as our private health care plans, and government payers which are Medicare, Medicaid, and Tricare.

Private Pay (Self-Pay)

Private pay obviously is when the client or the patient pays directly for the service. This is also called a Fee-for-Service payment. When you are in private pay, your rate setting guidance remains the same. Your charges must be usual and customary. The rates are the same regardless of the payer and any discounts need to be standardized and uniformly applied. In other words, you need to have written policies and procedures, so that all of your clients are treated consistently.

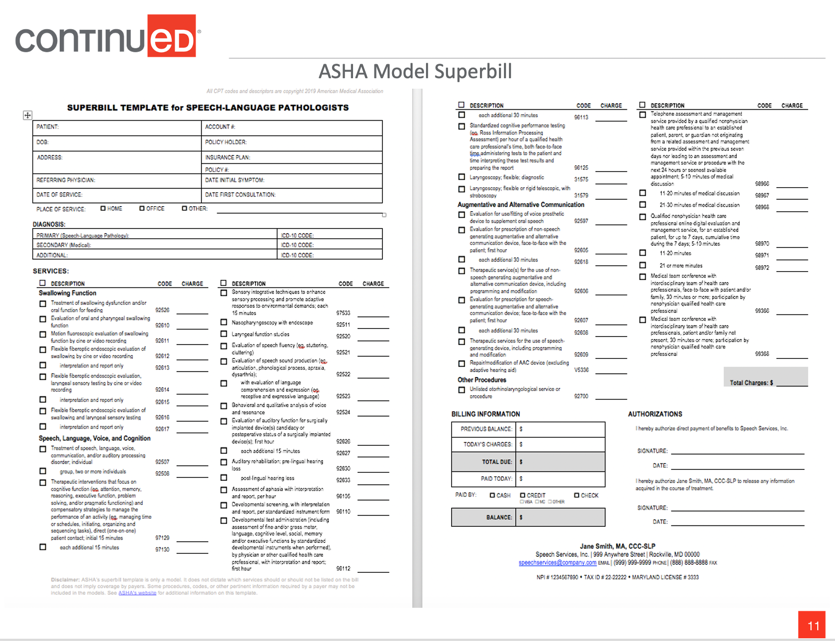

You are also required to have a claim form and I have provided an example of an ASHA model below (Click here for larger version of Figure 1).

Figure 1. ASHA Model Superbill.

Also, self-pay is usually not an option for Medicare or Medicaid beneficiaries. The reason for that is that speech-language pathology services are a covered benefit in Medicare and Medicaid. So if it's a covered benefit, then there's no reason for the beneficiary to be paying you out of pocket. There are examples of this and I want to give you a current example because of the public health emergency that we are in right now. For those who will be listening in the future, I should say that this is November 2020, currently and temporarily, SLPs are approved providers for telepractice for Medicare and Medicaid patients. However, CMS (Centers for Medicare and Medicaid Services) did not include coverage of procedure codes for dysphagia treatment, because, at this time, telepractice is not a covered service for Medicare Part B. If you have a Medicare Part B beneficiary who requires telepractice services for dysphagia treatment, then, in that case, you could bill that patient privately. And if you do so, I would recommend that you have an advanced beneficiary notice. This is a statement that explains the situation to the patient and they have signed it which gives written consent so that they are aware of this exception. That's just one exception, but it's temporary. Usually, self-pay is not an option for Medicare or Medicaid.

The self-pay option is not an exemption from documentation, supervision, or coding requirements. Sometimes I hear people say, "Well, I'm in private pay. I like being in private pay because I can just do what I want." No, not really. If you have a certificate of clinical competence, then you are recognized as having a level of excellence in the field of speech-language pathology and audiology that represents, "Rigorous academic and professional standards typically going beyond the minimum requirements for state licensure... and you have the knowledge, skills, and expertise to provide high-quality clinical services." So when you are credentialed, you're holding yourself out to the public as an expert, and you can be held liable for negligence that causes harm. Therefore, SLPs who have their CCC must abide by ASHA's code of ethics and the scope of practice, as well as abide by applicable state and federal laws and regulations that govern our practice. You can't just do what you want because you're in your own private practice.

Another question to consider is, "Does an SLP who accepts only self-paying clients in a small practice need to have a physician referral or signature on the plan of care?" (Consideration does not apply to Medicare or Medicaid beneficiaries since they should not be self-pay.) Your state practice act may allow direct patient access by you or a referral may be required. States are different. So, you need to know your payer source. You need to know their guidelines. If an SLP sees a patient without a referral, the patient needs to be informed upfront in case the patient plans to submit for reimbursement and the insurance company requires a referral. That's another reason to have a referral. I've been in clinical practice for a very long time and I always think that a referral is a good thing to have, whether it's a requirement or not.

The next consideration is, "May an independent SLP practitioner accept variable payment for services rendered, such as, 'just pay me what you can'?" As much as we would like to say that to our clients, we really can't. We need to have consistent policies. We must have the same policy for the discounts across the board. It's very dangerous to say, "Just pay me what you can." What you can do is develop a policy perhaps for a sliding scale based on income. The key is when you're in private pay, to always be consistent.

Commercial Payer (Private Health Plans)

Let's move on to commercial payers which are private health plans. These benefits may be accessed through individual purchase, employer-based health plans, or state exchanges. When you have a commercial payer, usually there is an out-of-pocket expense of some type for the patient or the client. They may have a deductible. There may be a co-insurance and there may be a co-payment. Supervision requirements will vary.

Managed care possibilities include referrals, pre-authorization, how many SLP services are covered, and how many treatment sessions can they have? The bottom line is to know your payers. You will hear me say that a number of times in this course. Know your payers because each one is different and their guidelines will differ.

Government Payer Sources

Government payer sources include Medicaid and Medicaid Advantage, Medicare and Medicare advantage which includes Part A, B, C, and D, and then we also have Tricare, which is healthcare for military members and families. So, there are many payer sources within the government.

Medicaid (Medical Aid). Let's talk about Medicaid first. Have you ever notice that the word Medicaid comes from medical aid? That's how it got its name. It's important to remember that Medicaid is a federal and state government partnership and it's implemented based on state priorities. That is a very big reason why Medicaid differs so much from state to state. However, in all states, Medicaid provides free or low-cost care, not only for low-income families and children, but also for pregnant women, the elderly, and people with disabilities.

It is the nation's largest payer of mental health services, long-term care services, and births. Four out of 10 births in the United States are covered by Medicaid. I had no idea what the latest figures were until I prepped to do a presentation on Medicaid. Forty percent of all births in the United States are covered by Medicaid.

Payment policies and rates for Medicaid and Medicaid Advantage plans vary widely from state to state and within a state, depending on the setting. Medicaid Advantage plan is a managed care plan through Medicaid. Medicaid also uses the same healthcare code sets that Medicare and most commercial payers use as well. Those are our ICD codes, International Classification of Diseases and Disorders and CPT codes, Current Procedural Terminology and both Medicare and Medicaid use those procedure codes.

The federal law requires states that participate in Medicaid to cover certain population groups, called mandatory groups, that give states the flexibility to cover other population groups. These are optional. Mandatory services include comprehensive services for children and optional services include rehab therapy and dental care. Again, this is why, when we have a question about a Medicaid payment, you have to be very specific as to whom you direct that question to and give them information that is specific to where you work and the service that you're providing. The oversight for Medicaid is your state department of health.

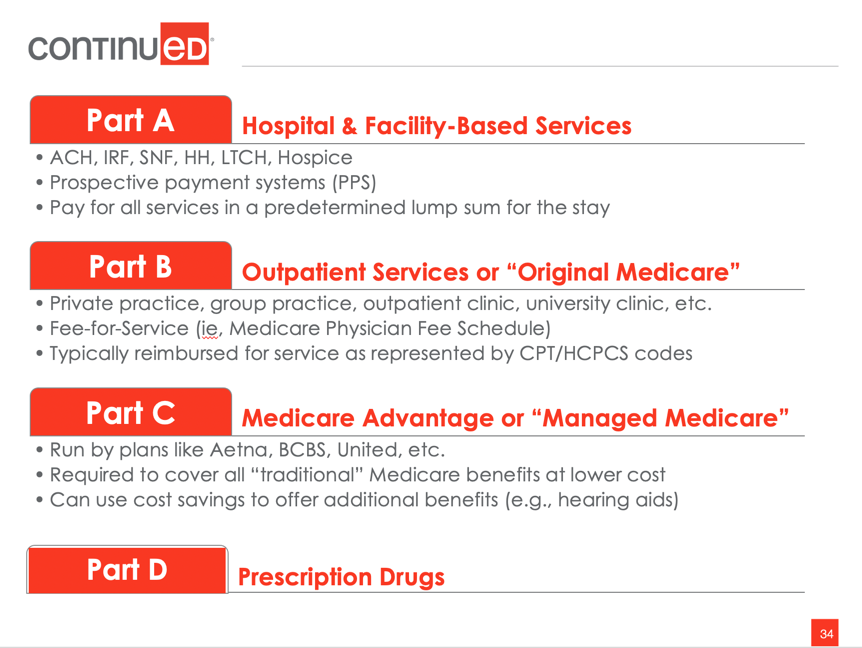

Medicare (Medical Care). Now to switch gears and talk about medical care, which we call Medicare. It is a federal program administered by the federal government and provides healthcare insurance. Medicare is the largest insurance company in the United States and is the largest payer of inpatient hospital services for the elderly and people with end-stage renal disease. It serves people ages 65 and older, and according to the statistics for 2019, we had over 1.2 million physicians and healthcare providers.

As I said earlier, Medicare has different parts - A, B and C - and each one is different. They differ by payment system, site of service and supervision policies. There are a couple of terms when we talk about Medicare that you need to be familiar with, and one is a MAC. A MAC is an acronym for Medicare Administrative Contractor. Basically, these are commercial companies that are contracted by the federal government and they are responsible for a particular region in the United States. They process Part A and B claims. Some of them also process claims for durable medical equipment, which we refer to as DME. Currently, we have 12 A/B MACs and four DME MACs. The Macs process Medicare Fee-for-Service claims for about 70% of the total Medicare beneficiary population.

It's important to know who your MAC is. Even though Medicare is a federal program, there's no central control. Know who your regional contractor is. You actually want to know who is at that office because that's the person you're going to call when you have a question about a Medicare claim or a beneficiary.

Another term that you will hear is LCD. An LCD stands for Local Coverage Determinations and these are decisions that are made by the MAC for whether to cover a particular item or a service within its jurisdiction. Unfortunately, not all of the jurisdictions are consistent. So again, if somebody in one part of the country is on social media and asks SLPs if Medicare covers a procedure and someone responds from another part of the country and says, "yes," that's is not necessarily true. Maybe in your jurisdiction it's covered, but not in the jurisdiction from where the other person is working.

The MAC decision is based on whether this service or item is considered reasonable and necessary. They can specify in this LCD, which services are or are not covered. So you need to be familiar with the LCDs that pertain to your services. I have resources for you to look up your MAC and follow the links to get the LCDs and to become familiar with what that whole process is.

Let's move on to Medicare Part C. Now that I am home a lot more, I have the TV on more often and I see so many commercials on TV for Medicare, particularly at this time of year, because between October 15th and the end of the year people can make changes to their Medicare coverage and/or select a different type of plan. Pay attention the next time you see those ads because they're not really coming from the government. They're coming from commercial companies that are contracted and they're providing what they call "Medicare Advantage Plans". That's the same thing as Medicare Part B and these companies are Managed Care Contractors. These companies are also contracted by CMS and each Medicare Advantage Plan is managed by the administrator of the specific company, whether it's Blue Cross Blue Shield, Humana, United, etc. There are a lot of them out there. So the company coverage determinations are going to vary based on which company has the particular Medicare Advantage Plan. Again, you need to know the managed care contractors.

Here's another tip. Let's say you have a patient that comes in for an appointment or you're speaking to them on the phone, and you ask them what insurance they have. They tell you that they have Medicare. Many times they don't know that there is a difference between Medicare Part B, which we now call original Medicare, and Medicare Part C which is the managed care plan. They don't realize that they have a managed care plan. It's not until they come into your office and hand over the card that you see that it's not Medicare Part B (the original Medicare plan), but it is a managed care plan. So, know about these Managed Care Contractors and know what their guidelines are.

Medicaid vs Medicare

If you think that this information is confusing, you're not alone. Many, many people confuse Medicaid and Medicare. I want to make it as simple as possible for you by providing the following information:

- Government-sponsored health care programs in the U.S. differ in the way they are governed and funded

- Medicaid is an assistance program that covers low- and no-income families and individuals

- 2019 served 75+ million Americans (35+ million children)

- Medicare is an insurance program that primarily covers seniors age 65 and older and disabled individuals who qualify for Social Security

- 2019 served 64 million Americans

- 2019 34% of Medicare-enrolled in Medicare Advantage plans

- Some may be eligible for both, depending on circumstances

First, they're both government-sponsored healthcare programs. However, think of Medicaid as "medical aid". It is an assistance program that covers low and no income families and individuals. Medicare is "medical care". It is an insurance program that primarily covers seniors over the age of 65. In 2019, we had over 75 million Americans on Medicaid and 35 or more million of those people were children. In 2019, we had 64 million Americans that were on Medicare and about 34% of those are now enrolled in the Medicare Advantage Plans and that number is increasing. It seems to be every year that the percentage of people in Medicare Advantage Plans is increasing.

Also, remember that because they're two different types of government programs, some individuals may be eligible for both programs depending on their circumstances. So don't be surprised if they come into your office and when you ask for insurance, they give you a Medicaid card and a Medicare card.

Below is a list of resources that cover all of the information that I just reviewed. You can follow the link listed to look for your MAC and LCDs in your area.

- Check with your state Medicaid agency for a fee schedule and provider manuals

- ASHA Medicare Information: www.asha.org/practice/reimbursement/Medicare/

- ASHA Medicaid Tool Kit: www.asha.org/Practice/reimbursement/medicaid/Medicaid-Toolkit/

- Affordable Care Act: www.medicaid.gov/AffordableCareAct/Provisions/Eligibility.html

- 2018 Medicare and Medicaid Basics: www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/Downloads/ProgramBasicsText-Only.pdf

- ASHA Model Superbill: https://www.asha.org/Practice/reimbursement/coding/Superbill-Templates-for-Audiologists-and-Speech-Language-Pathologists/

- Local Coverage Determination: https://www.cms.gov/medicare-coverage-database/indexes/lcd-state-index.aspx

- Medicare Administrative Contractors: https://www.cms.gov/Medicare/Medicare-Contracting/FFSProvCustSvcGen/MAC-Website-List

- 2020 Medicare Costs: https://www.medicare.gov/Pubs/pdf/11579-medicare-costs.pdf

Payment Systems

There are basically two types of payment systems, Prospective Payment System, which is mainly for inpatient services and Fee-for-Service, which is mainly for outpatient services.

Prospective Payment Systems (PPS)

Before we talk about the specifics, we need to know what a Prospective Payment System is. A Prospective Payment System is based on a predetermined, fixed lump sum amount for inpatient services. The payment amount is determined on admission using a patient assessment instrument that classifies patients into distinct groups. These groups are based on clinical characteristics and the expected resource needs.

Medicare Part A has a Prospective Payment System for each inpatient site of service. Wouldn't it be nice if we had just one for all Part A? But we don't. I'm not going to go through each one of these types of services, but I will discuss the ones that you are probably the most familiar with. By the way, it has been proposed by the Medicare Payment Advisory Commission to invest in a PPS for all post-acute settings. I think that would be really nice, but I don't see that happening in the foreseeable future.

The PPSs that you may be familiar with include: Diagnosis Related Groups (DRGs), Inpatient Rehabilitation PPS (IRF PPS), Patient Driven Payment Model (PDPM), and Patient-Driven Groupings Model (PDGM).

If you work in the hospital, I'm sure that you've heard of DRGs, Diagnosis Related Groups. This is for inpatient hospital services with the exception of some specific physician services in the hospital. The DRGs are determined by the organ system, the surgical procedure, the comorbidities and gender. Actual billing does not rely on minutes of service or CPT codes because these groups are predetermined. They have the factors and they are already predetermined. That doesn't mean that when you're in the hospital, you may not be asked to keep track of the number of minutes that you spend with a patient or the CPT code for the procedure that you use. But those are internal requests, as a request for data purposes. That's not what is sent to Medicare. The DRG number is what is sent to Medicare.

We also have inpatient rehab services (IRFs) and they also have their own payment system. We also have PDGM, the Patient-Driven Payment Model, which many of you may be familiar with if you work in a skilled nursing facility. We've been using that model for a year now. Patients are assigned to a case-mix group based on the primary diagnosis for admission, and then other relevant clinical and functional factors. (We could spend two days just talking about each one of these.) The minimum data set is what's used for the patient assessment. And actual billing does not use CPT codes. Again, that doesn't mean that you may not be asked to provide them, but actual billing is based upon the Patient-Driven Payment Model and the case-mix groups.

Finally, home health also has Patient-Driven Grouping Model. Home health patients are assigned to a weighted case-mix payment group based on the admission source. Did they come from the community? Did they come from the hospital? Did they come from the SNF? They are also based on clinical grouping, functional impairment, and comorbidities. Payments are based on a 30 day period. If you work in home health, you are certainly familiar with the outcome and assessment information set, better known as the OASIS, because this is what is used for functional skills assessment. I just want to reiterate that Medicare Part A falls under a Prospective Payment System.

Fee-for-Service

One of the drawbacks of fee-for-service is that it gives an incentive for physicians, SLPs, or any healthcare provider to provide more treatments because payment is dependent on the quantity of care rather than on the quality of care. The payment model is one in which the amount is paid for each service provided. For Medicare providers, fees for outpatient procedures are found in the Medicare Physician Fee Schedule (MPFS). If you look at that fee schedule, the patient, the Medicare beneficiary, who has original Medicare (i.e., Part B) is responsible for 80% of that fee and the other 20% will either be paid by supplemental insurance or out of pocket.

Payment is determined by the cost of resources needed to provide that service, including professional work, practice expense, and liability cost. If you've heard me speak before on coding and reimbursement, you've probably heard me say a great deal about what goes into the fee for each procedure that we provide.

Medical procedures are represented by a CPT or HCPCS code which stands for Current Procedural Terminology, which is a part of the Healthcare Common Procedure Coding System. For example, the CPT code for speech and language therapy is 92507 and the CPT code for dysphagia treatment is 92526. You may be familiar with these procedure codes. These are five-digit codes that represent procedures we do with our patients and clients.

Commercial payers typically base their fee-for-service payments on outpatient services on the Medicare Physician Fee Schedule. Services provided in outpatient practice settings are paid with a fee-for-service and include: private and group practices, outpatient clinics, comprehensive outpatient rehabilitation facilities, mental health, durable medical equipment, ambulance service, and clinical research.

Fee-for-Service (FFS) Medicare Part B - Outpatient. Not everyone has Part B Medicare coverage (aka, original Medicare). Part B is a voluntary program. It requires a payment of a monthly premium, which is typically deducted from their social security payment. For example, the standard Part B premium amount in 2020 is $144.60 cents a month, but that is dependent on your income. It can be much higher than that depending on what your income for the two previous years has been before you enroll. So, individuals may refuse enrollment and coverage, and they may choose some other type of coverage such as Medicare Part C.

One other point that is relevant to Medicare Part B, and particularly to speech-language pathologists and physical therapists, is that we have a yearly therapy threshold that applies to combined SLP and PT services. For 2020, that combined threshold was $2,080. If the charges go beyond that, and you can show that you are still providing skilled service, and your patient is benefiting from skilled services, then you put a KX modifier on your claim and that attests, that the particular service is medically necessary.

Fee-for-Service (FFS) Medicare Part C (Medicare Advantage Plans). Let's talk about the Fee-for-Service under Medicare Part C. As I have said, it is Medicare advantage. It is an alternative fee for service coverage program and is a form of managed care. I've already mentioned that CMS contracts with commercial companies to provide either Part A, or Part A and Part B benefits. It acts as a middleman between Medicare and service providers. Right now we have about one-third of all Medicare beneficiaries who have a Medicare Advantage Plan.

These Medicare Advantage Plans must cover all Medicare services except hospice care. Hospice care is covered under Medicare Part A. They may cover additional services or add-ons such as hearing services. If you pay attention to some of the advertisements, it's unbelievable what they claim that they cover and even say that they are "at no cost to you". Although they do have to cover all Medicare services, they don't have to cover them in the same way.

Advantage plans may require a referral. They may require submission of prior authorization. They can limit the number of sessions and they may determine a stay does not meet the criteria for an inpatient hospital stay and change it to an observation stay, which will impact the payment. Meaning, when a patient comes into the hospital and is first admitted, sometimes they come in through the emergency room, sometimes they go into an observation room and in those places that is still considered Part B, not Part A. So, the patient supervision is different and payment is different.

Likewise, in a skilled nursing facility, the first hundred days are Part A. If the patient receives services beyond the first hundred days, then those are under Part B. Of course, there are exceptions to everything which is why it is so important to know your payment system and your practice setting. Payment for Medicare Part C is also based on the Medicare Physician Fee Schedule and requires ICD and CPT codes.

Fee-For-Service Medicaid & Medicaid Managed Care. This one is also very confusing. It's a federal and state-funded program and payment is based on the Medicare Physician Fee Schedule. But the payment varies by state and varies depending on the site of service within each state.

Medicaid Managed Care contracts are awarded by the states, not the federal government (CMS), and the payments may change depending on the state budget and on grants. Again, this is still fee-for-service, but it's very inconsistent. So, when someone asks a question about Medicaid payment on social media, I want to cringe because I'm hesitant to provide any answer on Medicaid if I don't know all of the circumstances.

Consideration

Let's take a look at the following scenario and see if we can figure out what's wrong.

Mrs. Jones has original Medicare and was hospitalized for 6 days following admission for an acute CVA. Following her discharge from the hospital, Mrs. Jones received a bill from the hospital for 1 aphasia evaluation and 4 treatment sessions provided to her by an SLP while an in-patient.

Mrs. Jones has original Medicare, so that is Medicare Part B. Think about the site of service, the payment system, and the payer source and try to figure out what's wrong with this scenario. The site of service is hospital inpatient, the payment system is a Prospective Payment System, and the payer source is Medicare Part A. The problem with this scenario is that there shouldn't be a bill for SLP services because the beneficiary was an in-patient and Medicare covers Part A hospital inpatient services through a lump sum payment (PPS).

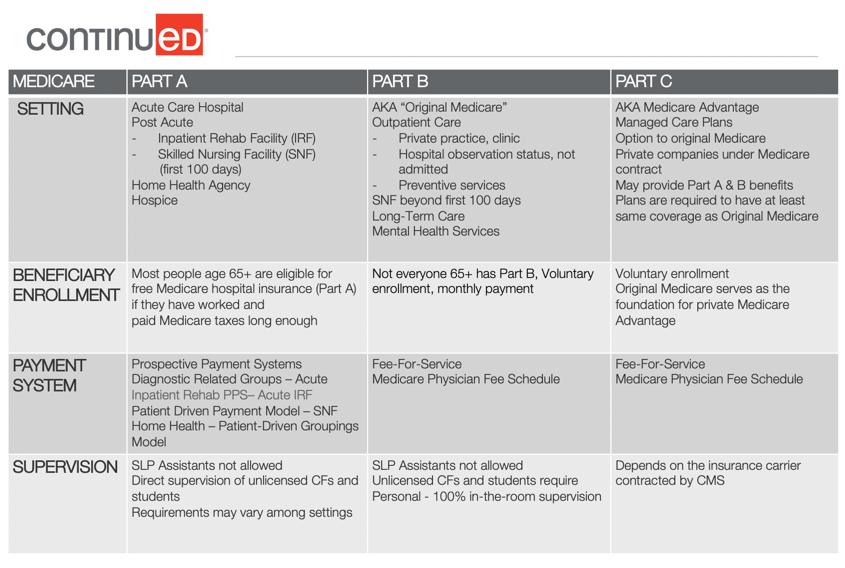

Here is a summary of some of the information I have provided so far. It's kind of a cheat sheet for you to use to distinguish the payer source, the payment system and the practice setting.

Figure 1.

Supervision

I'd like to move on to supervision and discuss it a bit differently than we normally think about it. I want to talk about it in terms of payment and compliance. Billing compliance and payment depends on your knowledge of the provider qualifications, payment guidelines and practice setting policies because they differ.

Guidelines

Rather than thinking of this as "ASHA Standards and Payer Guidelines" think of it as just supervision guidelines because it's neither ASHA's standards nor payer guidelines. It is both. Payer supervision guidelines may differ from ASHA supervision standards for students, clinical fellows, and SLP assistants. Supervision requirements also vary by payer and by the site of service. Here is a quick example: Medicare Part B (outpatient) requires 100% in-the-room supervision of unlicensed clinical fellows and students. But Medicare Part A (inpatient services) allows facilities to develop their own policies for direct supervision of students and unlicensed clinical fellows. So what does all of this mean and how do we maneuver this?

Let's start by considering who the centers for Medicare and Medicaid services consider to be a qualified provider. I'm not talking about an enrolled provider, I'm talking about a qualified provider. According to CMS, they consider a qualified provider as someone who is licensed by the state or who has the credentials, such as their CCCs, and clinical fellows who have been granted a temporary or provisional state license and are fully qualified to provide services according to Medicare regulations.

Who is not considered a qualified provider by the Centers for Medicare and Medicaid? Clinical fellows without temporary or provisional licensure are considered students and student interns are considered extensions of the credentialed SLP supervisor and are not considered qualified providers. Speech-language pathology assistants are not considered qualified providers for Medicare. Some Medicaid programs in some school settings and some commercial payers may accept SLP assistants. Requirements for a qualified provider are determined not only by federal regulation and state licensing boards, but also by the payer entities, including Medicare, Medicaid and commercial payers.

Centers for Medicare and Medicaid Services - Three Levels of Supervision Described

How does the Centers for Medicare and Medicaid Services define levels of supervision? They have three levels of supervision defined. The first and the least restrictive is general. General supervision requires the physician's involvement and that can be done by a referral and by a signature on the plan of care. Sometimes we will get a patient referred to us and we will only do an evaluation and the patient doesn't require any further services or we may be referring them elsewhere. Since we don't have a plan of care that the physician will sign, the referral, in that case, serves as the physician's involvement. If you recall, at the beginning of this course, I mentioned that I always feel more comfortable if I have a referral and a signature on the plan of care for any Medicare patient.

The second level of supervision is direct supervision which requires that the physician is immediately available while the procedure is being performed. It does not require the physician to be in the room, but they must be on the premises. Please note that during this time of the public health emergency, temporarily, direct supervision does include virtual availability. Prior to this, we could not do that. But during the public health emergency, we can now provide services and without the physician or the SLP supervisor being on the premises, they can be virtually available. Remember all of the courtesies that we have right now are temporary. We just have to stay tuned to how the developments proceed because we just don't know.

The third level is personal supervision. This requires that the physician, and "physician" in this case also means the supervising SLP, is present in the room during the performance of the procedure 100% of the time. For the most part, we fall under direct.

Medicare Part A – Hospital Supervision Regulations

What are the supervision requirements in Part A? As you know, hospitals are paid under the DRGs. The claims submitted by the hospital typically list the attending physician as the provider of record, not the individual service providers, such as the therapist. The physicians are onsite, in the hospital, and readily available in case of an emergency. For that reason, CMS has determined that hospital supervision is direct supervision. But, the responsibility of care always remains 100% with the supervising SLP provider.

Medicare Part A - Inpatient Rehabilitation Facilities (IRFs) Supervision Regulations

How about an IRF? CMS has no requirements or interpretive guidance prohibiting students from providing patient care as part of their training programs, but they do expect that all student therapy services will be provided by students under the supervision of a licensed therapist. Once again, you're in a hospital environment, so CMS requires direct supervision guidelines.

Medicare Part A – Skilled Nursing Facilities (SNFs) Supervision Regulations

Each SNF may determine its own manner of student supervision consistent with all federal state and local laws and professional practice guidelines. You always have your ASHA guidelines. CMS clarifies that the supervising clinician cannot treat another resident or supervise another student while the student is treating a resident. Additionally, the SLP supervisor must be on the premises and immediately available. Again, this is under the direct supervision guidelines. If you would like to find a direct reference, it is: https://www.asha.org/Practice/reimbursement/medicare/student_participation_slp/

Medicare Part B - Outpatient Supervision Regulations

I cannot say that this makes any sense to me, but outpatient supervision is 100% personal supervision of students by the qualified SLP supervisor. The only difference between Part A and Part B supervision is that the SLP supervisor has to be in the room with the student at all times directing the service. For some reason, I always think of our Part A patients who are in acute care, may need a little more supervision than those in outpatient, but I didn't make the regulations.

Only one billable service can be provided at one time by the supervisor. That means that the supervisor may not be treating and billing for another patient or supervising any other student at the same time. That rule applies to both individual and group therapy. But what I want you to remember, is that this personal supervision rule does not apply to non-Medicare beneficiaries. It is only for Medicare Part B beneficiaries that this personal supervision rule applies.

Medicare Part C & Commercial Payers - Outpatient Supervision Requirements

What about Part C and commercial payers for outpatient services? Almost all Medicare Part C plans require direct supervision, not personal, but direct supervision. But, again, be sure to verify that with each one of those contracted payers.

Medicare Payment Systems Summary

Here is another chart that is kind of a summary.

Figure 2.

This figure has beneficiary enrollment information, supervision information, and a breakout of the Medicare Parts A, B, and C.

Medicaid and Medicaid Managed Care Supervision Requirements

What are the supervision requirements for Medicaid? Each state Medicaid agency determines its own provider qualifications. Supervision requirements and billing procedures are going to vary not only by state but by district and by practice setting. Student provided services may not be billed in most settings, but there are exceptions. Clinical fellows are going to need to confirm the state requirements for billing specific to the setting where the service is. Speech-language pathologies assistants are not usually covered by Medicaid and healthcare settings, but they may be covered in public school systems. So, when dealing with Medicaid, not only do you need to know the state policies, but also the Medicaid requirements specific to the practice setting.

Again, the ASHA's Medicaid toolkit can provide some general assistance and other resources for you (www.asha.org/Practice/reimbursement/medicaid/Medicaid-Toolkit/).

One Final Consideration

Consider this scenario:

Dr. Harrison, CCC, SLP is the owner of a private practice and employees one other certified and licensed SLP and two SLP assistants. Their credentialed SLPs are enrolled Medicare providers. In Dr. Harrison's practice, all clients are evaluated by an SLP who also establishes the plan of care. SLPAs provide all individual and group treatment based on the plan of care. Medicare has paid the submitted claims for the past two years. Dr. Harrison was shocked when she was investigated for violation of the False Claims Act and faces possible fines and, or imprisonment. So, what happened?

First, the SLP did not adhere to federal law because Medicare does not reimburse services provided by assistants. What about the False Claims Act violations? There are a couple of violations that may have occurred. One is providing patients with substandard care because they do not consider the assistant as a qualified provider, right? The other violation would be billing for services provided by an unqualified Medicare provider.

Then, the question I always get is, "Why did Medicare pay?" Well, Medicare, and most other payers, pay first. Medicare pays first and then they review and ask questions. I know it doesn't make any sense, but that's the way it is. They pay upfront and then they do the reviews and ask the questions and take their money back.

Before using speech-language pathology assistants, please check your state laws for what they may or may not do in which practice settings, for example, school versus healthcare, because there's a difference there. And for which payer sources? Is it Medicare? Is it Medicaid or is it a commercial payer? Know your payer guidelines. The bottom line is that it is the ethical responsibility of an ASHA credentialed SLP to have knowledge of payer guidelines, payment systems, and practice settings.

Question and Answers

To clarify, Medicare covers 80% and Medicare advantage programs cover the other 20%. Is that correct?

Not exactly. Original Medicare covers 80% and then you can have a supplement that will cover the other 20%. A Medicare Advantage Program, Part C, may cover. The fee-for-services are set differently in the Medicare Advantage Program.

My administrator has asked me to sign off on treatment provided by a clinical fellow so they can bill Medicaid for the services. Should I do this?

Remember that Medicaid determinations are inconsistent and they vary considerably. So what I can give you is information based on Medicare, but you would definitely need to check to see if it would be the same for Medicaid. The first thing you would want to consider is if the CF has a provisional state license? If they do, then for Medicare in states where they have a provisional license, they're treated as a licensed practitioner and allowed to bill. So the supervision signature probably wouldn't be necessary in that case. But for Medicare, if the CF doesn't have a provisional license, they're considered the same as a student. So, you may sign those notes but only if you're the one who's provided the 100% supervision of the CF. But, again, within Medicaid, you've got to check specifically for that particular case in Medicaid.

Which treatment setting or facility has the most restrictive supervision requirements of students and unlicensed clinical fellows providing services to Medicare beneficiaries? Is it a hospital inpatient, skilled nursing facility, outpatient rehab clinic, or long-term care hospital?

The answer is in an outpatient clinical setting with 100% personal supervision for Medicare Part B.

I've heard that less supervision is required for students who work in skilled nursing facilities. What level of supervision is required for student interns who work in SNFs?

I've been saying direct student supervision for Part A Medicare beneficiaries in a SNF, right? But also remember, that is only for the first hundred days in the SNF. If skilled services are continued beyond that hundred days, then they are paid under Medicare Part B. In which case, the same therapist could go from being direct supervision to needing 100% supervision, go figure. But this is what I would do. If you're ever in doubt, always go with the more stringent application of supervision. It's better to have too much than not have enough. I am an SLP clinic supervisor in an outpatient clinic that has multiple payer sources. Each semester, we supervise graduate student interns.

Are SLP supervisors allowed to sign off on documentation by students that they have not personally supervised?

The SLP signature confirms that this SLP directed and supervise the treatment. The supervisor must review and co-sign the student's documentation and that signature says that you are taking full responsibility for the care of the patient. If claims are for Medicare Part B, remember that the student is simply considered an extension of the supervising SLP. So, you may not want to do that if you really have not been the supervisor for that student.

You mentioned 100 days for services. However, is this always accurate? In my facility, the payment is driven by progress.

You're absolutely correct. It doesn't mean that everybody's going to have a hundred days of service, but if it should progress beyond a hundred days, then it is no longer covered under Part A, it will be covered under Part B. You are correct. And not everybody stays a hundred days. They may only stay a week or a month. You're right, it depends on their progress.

References

CMS Reaffirms Student Participation in Hospitals and IRFs (Dec 2018) https://www.asha.org/News/2018/CMS-Reaffirms-Student-Participation-in-Hospitals-and-IRFs/

Medicare Coverage of Students & Clinical Fellows: Speech-Language Pathology (2018) http://www.asha.org/practice/reimbursement/medicare/student_participation_slp

Issues in Ethics: Supervision of Student Clinicians (2017) https://www.asha.org/Practice/ethics/Supervision-of-Student-Clinicians/

Issues in Ethics: Responsibilities of Individuals Who Mentor Clinical Fellows in Speech-Language Pathology (2017)

https://www.asha.org/Practice/ethics/Responsibilities-of-Individuals-Who-Mentor-Clinical-Fellows-in-Speech-Language-Pathology/

Medicare Benefit Policy Manual, Chapter 15, Sections 220 and 230.

Citation

Nikjeh, D. A.(2021). Payment for SLP Services: Navigating Payer Sources, Payment Systems, & Practice Settings. SpeechPathology.com, Article 20426. Available from www.speechpathology.com